Demand destruction is starting to have some impact. The price of oil has fallen substantially, to the point that the price may be artificially low, hovering around $100. The reasons have certainly to do with an overshoot in prices at $147/barrel and the rise in the dollar over recent weeks, but demand destruction plays its role. US crude oil consumption has dropped by upwards of 1million b/d over the previous year,taking some of the edge off demand. The puzzler, however, is world consumption is not yet in negative territory due to demand in Asia, particularly Chindia and every high rises in consumption in many OPEC nations, where gas (petrol) prices are subsidized. Additional downward pressure comes from the holiday seasons - more driving - ending and people getting back into normal routines. That is, the price decline is partly seasonal.

The takeaway is that demand is moderating due to demand destruction in some countries due to high prices, putting some downward pressure on prices, and, theoretically, oil production.

We need to remember, however, that it was only a year ago that $100 oil was considered a death knell for the world economy. The price rise to $147 has made $100 oil seem cheap by comparison. That is a mistake we cannot afford. The same pressure still applies to the economy, now even more weakened by the continuing chaos in the financial sector. This chaos will only continue and grow worse over time. The mortgage defaults have not even peaked yet and housing prices in the U.S. probably have another 15% to 30% - or more - to go till they bottom out. Mortgage defaults will continue through 2011. We're maybe 1/3 of the way through what is supposedly the cause of all this chaos. What this means is the price of oil truly is exacerbating the problem as people are paying much more for fuel and energy now than even a year ago, even with the price correction.

So, don't let the "low" price of oil fool you. It is still a very big drain on the world economy, it is not stopping the growth in demand on the global level, and is an indicator that Peak Oil is still with us. Even global demand destruction can only put off the inevitable. this brings us back to the events of today.

I would expect what happened today to add to demand destruction and start to spread that on a more global basis. I don't expect demand to actually decrease just yet, but the growth in demand should slow further with demand starting to retreat in the not-too-distant future as the global recession/depression takes hold. Great! Less fossil fuels being used means lower prices and a reduction in GHGs, right?

No and maybe. While demand may start falling globally, it may not keep pace with decline in oil production in older fields, and the rising consumption in OPEC and other oil producing nations will reduce exports. What does this mean? For oil net importing nations, Peak Oil is already here,or is just around the corner.

Briefly, old fields fall in their production over time as the oil in the fields is pumped out and the pressure drops to the point that only a small fraction of the peak production can still be extracted, and that only with massive inputs of effort, money, energy and technology. Since a majority of oil produced int he world comes from a very small number of the total fields on the planet, and those fields are all old and in or near decline, the decline rate is accelerating. Dick Cheney, may he roast in hell, stated the decline rate was 3%/yr. in 1999. Up until the last 6 to 8 months, the IEA held the decline rate to be 4.5%/yr. The current popular number is 5.2%, and even that is in question. The IEA will be releasing their most recent estimate in November, and it may be over 6%. We'll see.

This decline rate means we need a minimum of nearly 4 million barrels a day of new oil production each year. We're not getting it. The difference is being made up by unconventional oil (tar sands, etc), natural gas, etc., but oil itself has been flat since 2005. (Even with prices so high? Aren't they motivated to pump more? Yes. They can't.) So, our decline in consumption is not even meeting the need created by decline. Demand will have to fall by 4mb/d to avoid Peak Oil. That may happen, but not tomorrow. But even then, it wouldhave to keep falling because oil production will keep falling, and the rate is expected to accelerate as it already has been doing. 3%, 4.5%, 5.2%.... What's next? Don't know, but at 6% we need to produce or conserve 4.4 million more barrels a day each year just to keep even.

Then there's the net exports problem, well stated by the Export Land Model. This model says oil producing countries tend to have increasing demand at home which reduces exports over time. When the nation in question starts to decline in oil production, the problem only worsens, leading to exports declining at twice or three times the decline rate for that nation. This is a BIG DEAL.

Essentially, it means that oil importing nations like the US are facing Peak Oil now even though world production (of all petroleum liquids) is not falling. (Crude production is flat or falling, remember.) That decline rate, instead of being 5.2% or 6% ends up being the equivalent of 10% or more.

So... think about a world with oil falling at 10% a year. Then think about the financial storm we are now fully into. then think about climate Change and the need to, and cost of, ameliorating that... then add in food and water scarcity...

Don't get complacent. We are just getting started.

Original post:

But, then, it never was. Peak oil production (Peak Oil), or peak any commodity, is a material fact. In this case, a geological fact. There are limits to resources that the Earth holds and limits to how quickly we can produce them. That Peak Oil has arrived is not necessarily news to anyone who has followed what is called "Peak Oil," but it is important because it sets the point in time where the conversation can shift from

A: Peak Oil is REAL!to

B: No it ISN'T

A: Yes, it IS!

B: No, it ISN'T!

A: Nyah, nyah, nyah, nyah, nyah!In fact, much as it is now possible to just tune out the lies (Exxon and BuCheney administration 1 2 3 4) and bogus science (Exxon 1 2 3 and BuCheney Administration 1 2) about climate change, we can now just point to the data and return the conversation to solving the problem, leaving Peak Oil denialists babbling to themselves in the corner and chewing mindlessly on their SUV and foreclosed McMansion keys. 1 2 3 4

B: Your momma!

A: I told you! I told you! I told you! I told you!

B: You suck! Shut up.

HISTORY

Let me get to the point. World oil production has hinged on production from the Kingdom of Saudi Arabia (SA) since the first oil crisis in 1973. The primary reasons are two: At the time, the US was the world's largest producer of crude oil and SA was the third largest producer - and had the largest (conventional) crude oil reserves. In 1973 OPEC at that time produced 56% of the World's crude. 1 When they turned off the spigot, it was a serious problem. Historically, SA wanted the price of oil to be at equilibrium between making money and staving off competition. When prices have gotten too high, they have produced more oil. For example, during the 1979 "oil crisis," Iran shut in production, but SA took up the slack and fairly quickly added a million barrels per day (mb/d).

The developed world drastically cut their oil consumption because of the oil crises of 1973 and 1979. Alternative energy, conservation, nuclear, etc., were developing, CAFE standards were rising, Americans started buying economical little cars from Japan - even though they weren't sure about the quality. Jimmy Carter even put solar panels on the White House.

So, SA flooded the market. Additionally, in the late '70's Prudhoe Bay was finally ramping up production and the North Sea began producing in earnest. But the key point is, when they wanted to, they could ramp up production and did. So, in the late '80's and in the '90's we had a flood of oil and prices ranging between $10 and $30 a barrel - too low for alternatives to be developed causing many programs to shut down... and Ronald Reagan had taken the solar panels off the White House.

TODAY

How, then, are prices so high today? Why are alternatives being developed all over Hell's Half Acre? Why do the OPEC nations not only put up with, but invest in alternative "oil" and other energy sources? They can no longer produce at will. I can point you to a number of resources, one of which is a link to the right to comments and claims by Sadat al Husseini, a former head of production at ARAMCO. But the real secret gun, or, more accurately, shot heard round the world (only because people actually LISTENED to this one while ignoring many before it), was a recent article in Business Week. It reiterated what al Husseini had already said: the KSA would never produce more than 12.5 million barrels of oil a day (mb/d). Actually, Business Week (BW) said 12.0. The key to taking the BW article seriously is the source. It purports to have received inside info from a current high ranking employee. al Husseini, you see, is a former employee, thus it was possible to dismiss him as disgruntled. So, the open secret is now just common knowledge: SA can't give much more than it already is.

Why This Is Important

There is a very good discussion of this article by Dave Cohen of ASPO USA, but let me repeat some things he says and add a bit here and there of my own. That is, let me simplify.

1. Oil production = economic development

2. Oil production = food production

3. Oil production = a large percentage of transporation

4. Renewables do not = oil production and are unlikely to take up the slack quickly enough to avoid major economic and social disruptions.

Let's look at a graph of population and energy usage. Pay attention to the green zone. That is the amount of population a pre-fossil fuels world supported and likely would have supported to this day. What developments would we have now that we could also have had without fossil fuels? Cars? Skyscrapers? Food shipped in from all over the world? Cell phones? No. It is an inescapable reality that the world we have created is a direct result of cheap, seemingly abundant, energy.

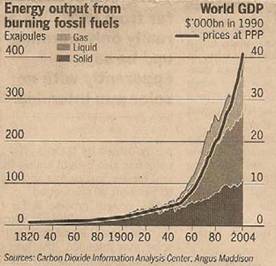

Let's look at a graph of population and energy usage. Pay attention to the green zone. That is the amount of population a pre-fossil fuels world supported and likely would have supported to this day. What developments would we have now that we could also have had without fossil fuels? Cars? Skyscrapers? Food shipped in from all over the world? Cell phones? No. It is an inescapable reality that the world we have created is a direct result of cheap, seemingly abundant, energy. Look at this graph of global fossil fuels use and economic growth. It's a pretty good match, don't you think? Common sense tells us that without the cheap energy provided by first coal, then oil, we would not have been able to develop as we have. (At least, those of us in the OECD.) Our infrastructure road and cars), the food to feed so many (fertilizers) and even everyday items (look around your house and try to think of something that has no petroleum involved in its production or transport) all rely on oil. Even at $140 a barrel oil is about 16.75 cents a cup or $3 a gallon. You can't get a cup of coffee for anywhere near 17 cents. (h/t Matt Simmons.)

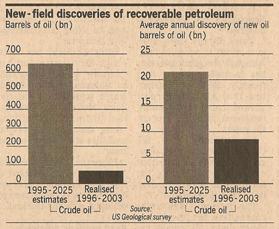

Look at this graph of global fossil fuels use and economic growth. It's a pretty good match, don't you think? Common sense tells us that without the cheap energy provided by first coal, then oil, we would not have been able to develop as we have. (At least, those of us in the OECD.) Our infrastructure road and cars), the food to feed so many (fertilizers) and even everyday items (look around your house and try to think of something that has no petroleum involved in its production or transport) all rely on oil. Even at $140 a barrel oil is about 16.75 cents a cup or $3 a gallon. You can't get a cup of coffee for anywhere near 17 cents. (h/t Matt Simmons.) Now look at another graph of the U.S. Energy Information Agency's (EIA) former projected global discoveries of oil world production and actual production. There is a huge difference between the projected and actual. Why? Well, OPEC can produce ad nauseum and we'll keep discovering at the same rate as always! Simple! Sure, simple as in idiotic. All the EIA had to do was look at a graph of past discoveries to know they were blowing smoke up their own arses. So, if we are not discovering more oil at the same rate we once did, how can we expect to keep producing it at the same rate? We can't. Now we have the proof we need to prove this without further debate or argument. If SA is at their limit, the world is at its limit, just as Matt Simmons has been saying.

Now look at another graph of the U.S. Energy Information Agency's (EIA) former projected global discoveries of oil world production and actual production. There is a huge difference between the projected and actual. Why? Well, OPEC can produce ad nauseum and we'll keep discovering at the same rate as always! Simple! Sure, simple as in idiotic. All the EIA had to do was look at a graph of past discoveries to know they were blowing smoke up their own arses. So, if we are not discovering more oil at the same rate we once did, how can we expect to keep producing it at the same rate? We can't. Now we have the proof we need to prove this without further debate or argument. If SA is at their limit, the world is at its limit, just as Matt Simmons has been saying. Take a look at a graphical illustration of the problem. Even though this graph is a couple years out of date, it still accurately reflects the problem. There have been some new discoveries - there always are - but none that are going to change the future because they are too small. Look at all that space under the black line. That's draining world reserves at a rapid rate. Perhaps you've heard of 30 billion barrels found off Brazil? Even if every barrel were recoverable (they aren't) and they could be gotten out in one year (instead of 30 to 50), it would still only give enough oil for the world to use for.... one year. And that's the biggest find in decades.

Take a look at a graphical illustration of the problem. Even though this graph is a couple years out of date, it still accurately reflects the problem. There have been some new discoveries - there always are - but none that are going to change the future because they are too small. Look at all that space under the black line. That's draining world reserves at a rapid rate. Perhaps you've heard of 30 billion barrels found off Brazil? Even if every barrel were recoverable (they aren't) and they could be gotten out in one year (instead of 30 to 50), it would still only give enough oil for the world to use for.... one year. And that's the biggest find in decades.The assumption has been that OPEC, and SA in particular, could produce at will and would cover future demand growth. Why? Just because. That's right. because they had, it was reasoned, they always would. That was a false assumption. To be fair, one reason the USGS and others bought this lie was because of surious reserves growth in OPEC in the 1980's. Oil reserves in the Middle East/OPEC were doubled over night. Political and economic considerations created the necessary lie. Sadat al Husseini essentially confirmed this by telling us last October that oil reserves were overstated by some 300,000,000,000 barrels. Interestingly, this matches up with the spurious increases in reserves in the 80's.

You say, "So? Who cares? They're pumping enough oil now. Two or three mb/d more from SA sure sounds like a lot to me!!" Except it isn't. As many had suspected, the declining production from older fields is accelerating. Assumed to be 4% a year just one year ago, now the International Energy Agency (IEA) says it is at 5.2% a year. If current all liquids (oil, gas, tar sands, etc.) production is 86.5 mb/d, then we are losing 4.5 mb/d each year. That's almost as much as the US produces and half of what SA produces. Basically, we would have to find, and start producing oil from, a field equal to the biggest field ever found (Ghawar in SA) every year just to keep production flat. As already discussed, that's not happening.

"B-b-b-but there are other places to drill! Other countries to produce!" Yup. And you already know how that turns out. Go back to the graph. Why that decline rate is speeding up? The US - once the world's largest oil producer at over 11 mb/d - has been declining since 1970, less a small bump from Alaskan oil. The North Sea, the largest complex of oil found and developed in many decades has been in decline since around 1999. Mexico, also one of the top ten, has been declining since 2004. Russia, the Number 2 oil producer in the world, started their second decline (their real peak was at the time of the break up of the USSR, which caused a huge decline in production that had recovered until recently) late in 2007. There are no other massive producers, and there won't be.

How can we say there will be no more megaproducers? Imagine a hay stack. In the haystack are 10 basketballs, 100 tennis balls and 1000 marbles. Which are you going to find first? Second? Last? Yes, you will certainly find some of the tennis balls and marbles before you find all the basketballs, but you just as certainly will find all the basketballs before you find all the tennis balls, and all the tennis balls before you find all the marbles. Oil is the same. We're down to a few tennis balls and a bunch of marbles.

And that is why SA peaking by 2011 (their stated goal to reach 12.5 mb/d) is important. That rising production cannot be replaced. We have reached the end of the road with regard to oil production. It has reached or will reach its absolute peak between now and 2012.

What It All Means

As you can see, the peak is nigh, but renewables are decades from being able to replace them 100%. (Keep in mind there are some things only a substance like oil can do. Some things we have and/or do today will be going the way of the Dodo.) The pinnacle of oil production means the end of the world as you know it. A new world will have to rise in its place, or this one will simply die out. Solar is too expensive and not nearly widespread enough. Do you have it? I don't. What percentage of roofs do you see with panels? The percentage is small overall.

What about wind? Those big wind farms? Don't want them around? How about a mini system buzzing in your yard? There are only 105,000,000 households in the US. Surely we can build that many windmills in just three years! Uh... right? Right?! (Sorry, no.)

I know! I know! Ooooh! Pick meeee!!! Biofuels!! Sure. OK. We're making about 23 million barrels a year in the US. We need 31.5 billion barrels a day to replace world oil demand. Good luck with that.

"Hey, what about nuclear," says the heckler in the back. Nuclear, schmuclear, I say. At around 12 billion a pop, building the 1,000 we need in the US and the 10,000 we need around the world is just not doable. And it's not just money, there are steel shortages, there's only one producer of containment vessels who can build something like four a year. Etc.

Time is a problem.

Luckily, the things we do (except for food being turned into biofuels and raising food prices through the roof) for Climate Change are basically the same that we need to do for Peak Oil: reduce, reuse, recycle, localize.

Now that you know peak oil is here, let's not be shy about discussing solutions. Watch for my future posts. Hopefully the next won't be several months coming! In the meantime, look at my TEOTWAWKI and Build Out posts. And don't forget: A Perfect Storm Cometh. Remember to factor in the economic crisis (Can we afford the solution?) and Climate Change (Can we handle all three at the same time?) when thinking about all this.

No comments:

Post a Comment

Comments appreciated, but be polite; I like to edit.

Cheers